With the clock ticking, the new boss of Ontario’s real estate regulator is keeping all options open as he tries to reform the disgraced organization.

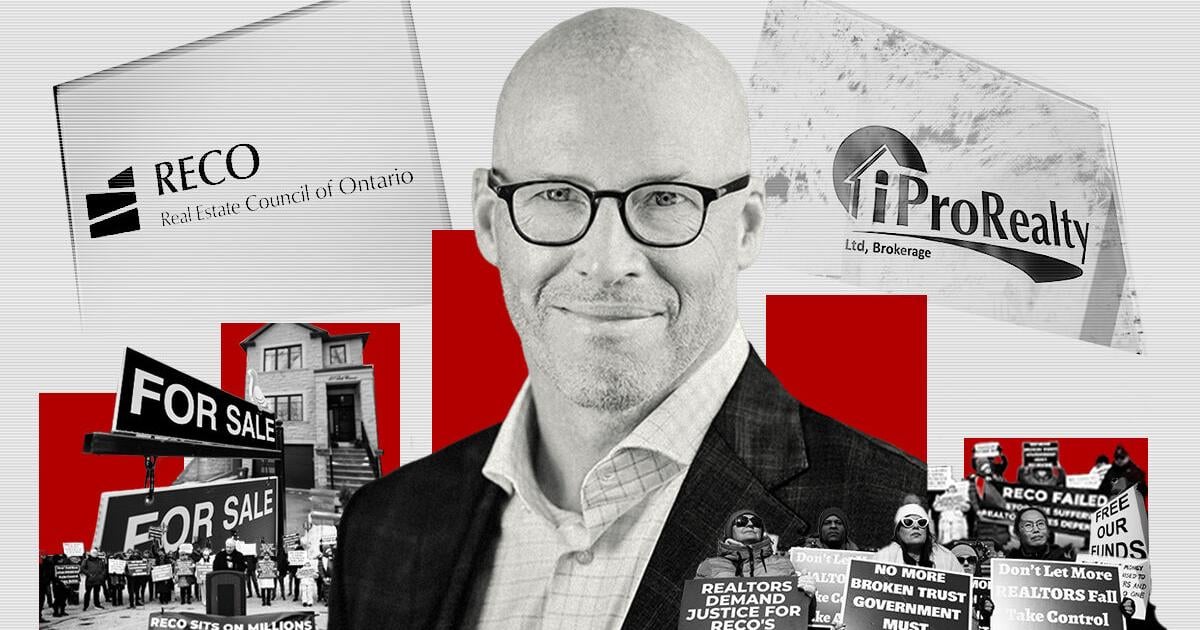

Jean Lépine, an Ottawa-based crisis expert, has a mandate to scrub the Real Estate Council of Ontario (RECO) from top to bottom — and he hasn’t ruled out the possibility of disbanding the organization altogether, he told the Star in a recent interview.

Industry veterans want to give Lépine the benefit of the doubt, but he only has a maximum of 250 days — at a rate of $2,000 a day, assuming a five-day work week — to reform or scrap the organization.

The Ontario government appointed Lépine to fix the regulator after it concealed the largest trust breach in its history for three months, allowing iPro Realty — which had $10.5 million missing from its trust accounts — to process more than $700 million in transactions while its owners cut a deal to sell their empire and evade regulatory fines and charges.

Lépine is now facing skepticism due to his lack of experience in the sector and his vague plan for fixing RECO over the coming months. He has also been criticized for the slow pace of change and for not immediately implementing a more robust audit system to stop bad actors and protect consumers.

“If he doesn’t implement a new auditing system in the next 90 days, it’s not a matter of if another iPro happens, but when,” said Steve Tabrizi, chief operating officer at Re/Max Hallmark.

Lépine says he’s still at the beginning of the process.

“I’m not discounting anything … I’m trying to work as fast as I can, having just arrived here, to try and implement changes that will set us up better for the future.”

In his first interview with the Star since beginning his tenure, Lépine addressed increasing complaints from industry insiders who are worried the clock will run out before he makes any meaningful changes.

Getting up to speed

Lépine’s lack of real estate experience puts him at a disadvantage to work swiftly to fix RECO, critics say, putting pressure on the Ford government appointee to “get up to speed quickly,” because the problems at RECO run deep.

Lépine, who has spent the last two decades working in communications, government and investor relations, said he intends to collaborate with industry leaders through town halls, gathering feedback on how make meaningful change.

“I don’t intend to do this just in house. We’ll work with experts and we’ll work with the sector and I intend to have summits and town halls — something this organization, I would say, hasn’t done a great job at,” Lépine told the Star in a recent phone interview.

“There will be plenty of opportunity for the folks to get involved and to provide us with good counsel and be a part of the change that this organization needs to see.”

On Jan. 27, RECO held a “collaboration summit,” the first of many, bringing together real estate boards, brokerages, professional associations, and the government to discuss how to improve oversight of the sector with a focus on three priority areas: annual brokerage financial filings, trust account oversight, and the insurance program.

Tabrizi said he spoke with Lépine over Zoom before the holidays. He liked that Lépine acknowledged “serious problems” within RECO and that he admitted he didn’t know the industry, and therefore needed guidance. But he felt Lépine was not focused on the most important reform for the organization, which is a robust auditing system.

Todd Shyiak, executive vice-president of Century 21 Canada, which has more than 40 brokerages in the GTA alone, said Lépine hadn’t reached out directly. He said the new administrator must work harder to “get up to speed quickly,” by consulting with as many industry veterans as possible.

“It’s too early to say how he’s is doing,” Shyiak said. “It’s time for the industry to give him a little bit of space to get things straight.”

Consumer protection safeguards come first

Lépine has already scored a big win by promising to pay back impacted realtors 100 per cent of their commissions, after initially just offering 50 per cent.

The regulator’s insurer, Alternative Risk Services, initially projected a total loss of $30 million in realtor commissions, based on the claims received.

RECO told the Star that figure “includes future commissions for sales that have yet to close,” which is subject to change “as transactions occur, and claims are submitted and assessed for eligibility.”

Around $5 million in consumer deposit claims have already been paid out, with all affected consumers paid back their full deposits.

Lépine also fired the entire board his first day on the job and accepted the resignation of the former CEO.

While applauding this work, industry critics say Lépine’s plan to reform the organization is missing the most vital component to ensure consumers are protected: a robust new auditing system to catch bad actors.

On Jan. 8, Lépine outlined organizational priorities, a new corporate structure and executive team. The “eight major transformation initiatives of 2026” include a “culture renewal plan underpinned by a new performance management system,” an initiative he called “regulatory modernization,” and “renewed governance.”

Critics called the plan ”lipstick on a pig,” and “whitewash.”

Tabrizi said Lépine’s transformation plan suggests he’s not heeding his advice.

RECO needs to implement auditing changes immediately — in the next 90 days — to protect consumers and agents, he said.

“There are not enough inspectors to audit all of the brokerages in Ontario,” he said. “We need to automate reconciliation (financial statements) reporting with a pass or reject feature for monthly statements that aren’t balanced. That could trigger an audit that might not even have been planned.”

The current risk-based auditing model RECO uses means brokerage’s are audited based on their risk, which is assessed from prior performance — the higher the risk, the more frequent the audit.

RECO has said iPro was not a high-risk brokerage, and it hadn’t been audited in four years.

Tabrizi said Lépine needs to create a plan that addresses the regulator’s auditing and reporting mechanisms and the authority of the registrar.

“That’s why we’re in this fiasco. Those are the priorities,” he said.

Century 21’s Shyiak said a new system needs to “quickly uncover bad players without placing too much burden on those operating with integrity,” and before bad players “cause too much damage to the public or to the real estate industry at large.”

Lépine told the Star he’s working with the real estate sector on “three, maybe four major reforms” in the short term that include: trust account oversight, annual financial filings, insurance program and education, but did not explain what’s involved. He added he’s determined to “build plans to ensure that this never happens again.”

On Jan. 29, in a press release, Lépine said in the coming weeks, RECO will be assessing oversight measures “that reinforce compliance expectations across the sector,” with the main goal to improve trust account oversight.

Can RECO truly be reformed?

Cathy Polan, president of the Ontario Real Estate Association (OREA), which represents nearly 100,000 brokers and salespeople, applauded Lépine’s payout decision but said there is “more to be done to fully earn back the confidence of the real estate sector and consumers.”

Over the last few years, Polan said, RECO has moved away from its core mandate of enforcing the Trust in Real Estate Services Act (TRESA) — consumer protection legislation governing real estate agents and brokerages.

“When you take on too much, like they have, things fall through the cracks,” she said.

She said there have been delays in getting the curriculum updated at RECO-approved institutions to reflect current TRESA regulations, as well as students having issues trying to enter the program and current students unable to book exams.

She recommended OREA take on that work to alleviate some of RECO’s responsibilities.

“Ontario realtors believe that no single body should both teach the rules and police them,” she said. “It’s like grading your own homework.”

But others in the industry think there isn’t a place for RECO at all in the real estate landscape.

“Culture change and a consumer awareness campaign is not going to address the necessary fundamentals of making sure nobody cheats,” mortgage broker Ron Butler told the Star. “Bold change is folding RECO into FSRA.”

FSRA is the Financial Services Regulatory Agency of Ontario, which regulates key financial sectors that deal with other peoples money: mortgage brokers, insurance, credit unions, and pension plans.

“The reality is that this organization did enormous wrong,” he said of RECO. “The call to develop an active plan that will lead right back to industry members taking control of RECO does not seem like a good idea to me.”

The move would be striking but not unprecedented in Canada. In 2021 in B.C., the Real Estate Council of BC and the Office of the Superintendent of Real Estate were integrated into the BC Financial Services Authority (BCFSA), creating one regulator for the entire financial services sector, to streamline oversight and enhance consumer protection.

“The integration took approximately 18 months,” a BCFSA spokesperson told the Star, noting the move was a direct response to an independent review that found self-regulation was no longer enough to protect the public.

FSRA already has strong systems in place to audit financial fraud, Butler said, and is an organization built around consumer protection.

Lépine said he hasn’t ruled out this option but his job is to work with the sector, deliver on an “ambitious plan, which I’ve published,” and execute on the mandate of the organization, which is to deliver “consumer protection to the best of its capabilities.”

Meanwhile, the clock keeps ticking. The ministry order appointing Lépine gave him until Dec. 31 to deliver his final written report, which is when his pay, a maximum salary of $500,000 plus $35,000 in “reasonable expenses” runs out.

“Clearly change is required here and that’s what I’m going to do,” Lépine said. “I’m going to make sure that we take action not just talk about it.”